Listen To Article

Listen To Article

Kambi has reported Q1 revenue of €44m ($48.5m) – a 19% year-on-year rise.

However, operating profit (EBIT) was down 38% to €4.5m, with the EBIT margin also falling from 19.9% to 10.3%. This, the supplier says, was impacted by “certain non-recurring costs.”

EBITDA, too, fell 24% to €5.8m, with Kambi’s EBITDA margin down from 20.8% to 13.1%.

Following Kambi’s report, its share price fell 8% to SEK 169.20 ($16.49).

For its Q1 highlights, the sports betting provider referenced operator turnover growth of 12% and operator revenue growth of 19% – primarily driven by US.

It also emphasised its AI-driven algorithmic trading capability, as well as “successful” Super Bowl and March Madness events.

Kambi CEO Kristian Nylén was understandably keen to single out Latin America, stating: “The first quarter was another busy period for Kambi including new market launches in the Americas, the expansion of Kambi’s partner network and a full sporting calendar.

“Latin America is a region of significant long-term potential for Kambi and will become increasingly integral as we look to extend our position across the Americas.

“Kambi already has a strong foothold in some of the region’s most established sports betting markets such as Colombia and Argentina, and recent public announcements from the Brazilian Government show positive signs that regulation of sports betting in Brazil is edging nearer in what is projected to become one of the world’s largest regulated markets.”

With a slight cautionary tone, he added: “The road towards our long-term financial targets won’t be linear, but we are carefully putting in place the fundamentals which will enable us to accelerate as we progress.”

Strong revenue growth but operating profit and EBITDA stutter

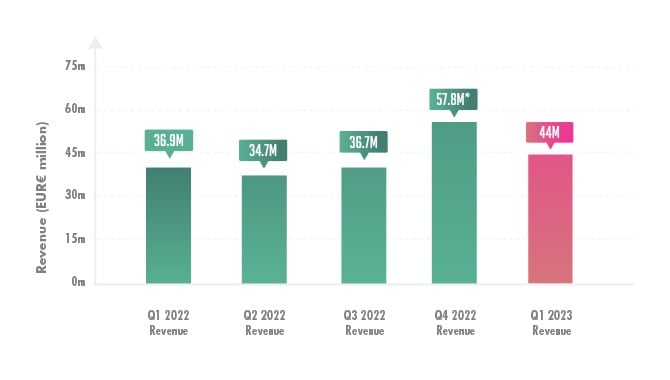

If we are to compare Kambi’s Q1 2023 revenue to its quarterly reports last year, we do see strong growth in this area (as the above graph shows).

Kambi’s revenue was relatively steady throughout 2022, hitting between €34-€37m. This is except for Q4, when World Cup football and a “busy US sporting calendar” buoyed the supplier’s ps to €57.8m*.

However, there is a slight asterisk here due to the one-off €12.6m cancellation fee paid by Penn Entertainment (which inflates the numbers).

Overall, though, the market did not initially react favourably to a Q1 revenue rise that was tampered by a considerable dip in operating profit.